The Ultimate Guide To Paul B Insurance Medigap

Wiki Article

The Best Strategy To Use For Paul B Insurance Medigap

Table of ContentsNot known Incorrect Statements About Paul B Insurance Medigap 9 Simple Techniques For Paul B Insurance MedigapNot known Facts About Paul B Insurance Medigap4 Easy Facts About Paul B Insurance Medigap ShownRumored Buzz on Paul B Insurance Medigap

Eye health and wellness ends up being more vital as we age. Eye examinations, glasses, and calls are a part of lots of Medicare Advantage plans. Original Medicare doesn't cover listening devices, which can be pricey. Lots of Medicare Advantage intends supply hearing insurance coverage that includes testing and also clinically required hearing aids. Medicare Advantage plans provide you choices for maintaining a healthy way of life.Insurance that is acquired by an individual for single-person coverage or protection of a family members. The private pays the costs, instead of employer-based medical insurance where the employer commonly pays a share of the costs. Individuals may look for and also purchase insurance from any plans available in the individual's geographical area.

People as well as families might qualify for monetary support to lower the expense of insurance coverage costs and out-of-pocket expenses, yet only when signing up with Attach for Health Colorado. If you experience particular adjustments in your life,, you are eligible for a 60-day period of time where you can enlist in an individual plan, also if it is outside of the yearly open registration duration of Nov.

Some Known Details About Paul B Insurance Medigap

15.Any individual age 65 or older certifies for Medicare, which is a federal program that provides economical healthcare coverage. There are some considerable distinctions between Medicare and private insurance policy strategy alternatives, coverage, costs, and more.

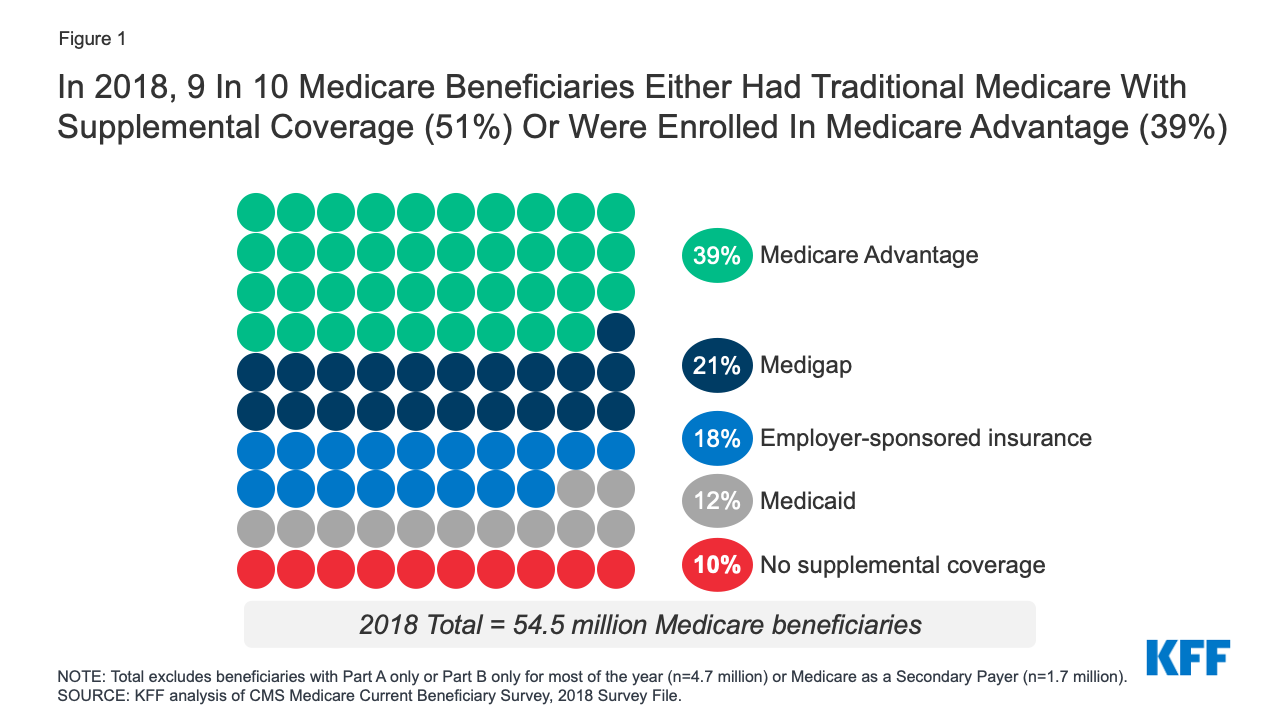

Medicare Benefit (Component C), Part D, as well as Medigap are all optional Medicare strategies that are marketed by personal insurance provider. Medicare Benefit plans are a prominent option for Medicare recipients because they provide all-in-one Medicare coverage - paul b insurance medigap. This consists of original Medicare, as well as most strategies additionally cover prescription medications, oral, vision, hearing, as well as various other health and wellness advantages.

The differences between Medicare and also exclusive insurance coverage are a substantial element in determining what type of strategy could function best for you. When you register in Medicare, there are 2 major components that make up your insurance coverage: There are lots of choices for acquiring exclusive insurance policy. Lots of people purchase personal insurance policy through their company, and also their company pays a section of the costs for this insurance policy as a benefit.

The Best Strategy To Use For Paul B Insurance Medigap

There are four rates of private insurance strategies within the insurance exchange markets. These rates vary based on the percentage of services you are in charge of paying. cover 60 percent of your health care prices. Bronze plans have the greatest deductible of all the strategies yet the most affordable monthly premium. cover 70 percent of your healthcare prices.

Gold plans have a much reduced insurance deductible than bronze or silver strategies however with a high monthly premium. Platinum plans have the most affordable insurance deductible, so your insurance policy usually pays out extremely swiftly, however they have the highest possible month-to-month premium.

In enhancement, some private insurance coverage business also market Medicare in the forms of Medicare Benefit, Component D, and also Medigap plans. The coverage you obtain when you authorize up for Medicare depends on what type of plan you choose.

If you need added protection under your plan, you need to pick one that offers all-in-one insurance coverage or add added insurance strategies. You could have a plan that covers your medical care solutions but needs additional strategies for dental, vision, and life insurance policy benefits. Nearly all health and wellness insurance policy plans, private or otherwise, have prices such a premium, insurance deductible, copayments, and also coinsurance.

The 4-Minute Rule for Paul B Insurance Medigap

There are a range of costs linked with Medicare protection, depending on what type of strategy you choose. Here is a take a look at the costs you'll see with Medicare in 2021: The majority of people are qualified for premium-free Part An insurance coverage. If you have not worked an overall of click here to find out more 40 quarters (ten years) throughout your life, the month-to-month premium ranges from $259 visit homepage to $471.The day-to-day coinsurance prices for inpatient care array from $185. The insurance deductible is $203 for the year. Coinsurance is 20 percent of the Medicare-approved expense for services after the deductible has been paid.

These quantities vary based upon the plan you pick. Along with spending for components An and B, Part D prices vary relying on what sort of drug protection you need, which drugs you're taking, as well as what your costs and insurance deductible quantities consist of. The monthly and annual cost for Medigap will certainly depend upon what kind of strategy you choose.

One of the most a Medicare Benefit plan can bill in out-of-pocket expenses is $7,550 in 2021. paul b insurance medigap. Original Medicare (parts An as well as B) does not have an out-of-pocket max, meaning that your medical costs can swiftly include up. Below is a summary of several of the common insurance prices as well as exactly how they deal with respect to private insurance: A premium is the month-to-month price of your health insurance strategy.

Getting My Paul B Insurance Medigap To Work

Coinsurance is a percentage of the complete accepted price of a solution that you are in charge of paying after you've met your deductible. All of these expenses depend on the kind of private insurance policy strategy you pick. Analyze your monetary circumstance to identify what sort of month-to-month and yearly settlements you can manage.

Report this wiki page